Look, no one’s guaranteeing you won’t lose money in crypto—it’s volatile AF, and pretending otherwise is bullshit. But there are ways to stack the odds so heavily in your favor that “losing everything” becomes way less likely. I’ve tried the hype-chasing, the FOMO buys, the “this shitcoin will 100x” delusions, and they all bit me in the ass. These days, my approach to safe crypto investing is boring on purpose, and honestly, it’s the only reason I’m not broke.

My Biggest Screw-Ups in Crypto Investing (So You Don’t Repeat Them)

God, where do I even start? Back in 2021, I dumped way too much into Dogecoin because Elon tweeted something dumb—woke up to it tanking 30% and panicked sold at the bottom. Embarrassing as hell, like texting your ex at 2am levels of regret. Or that time in 2022 when FTX blew up and I had funds there—thankfully not life-changing amounts, but enough to make me sweat bullets reading the news over breakfast tacos here in the US. Sensory overload: the panic scrolls on Twitter (yeah, I still call it that), the endless Reddit threads, my heart racing like I’d chugged three espressos.

The raw truth? I was greedy, emotional, and didn’t do jack shit for research. Contradictory as it sounds, I thought I was “diversifying” by buying 10 random memecoins, but really I was just gambling. Now, in 2026 with Bitcoin pushing past old highs again, I look back and cringe— but those losses taught me everything about how to invest in crypto without losing money.

The Real Way to Safe Crypto Investing: Dollar-Cost Averaging Saved My Ass

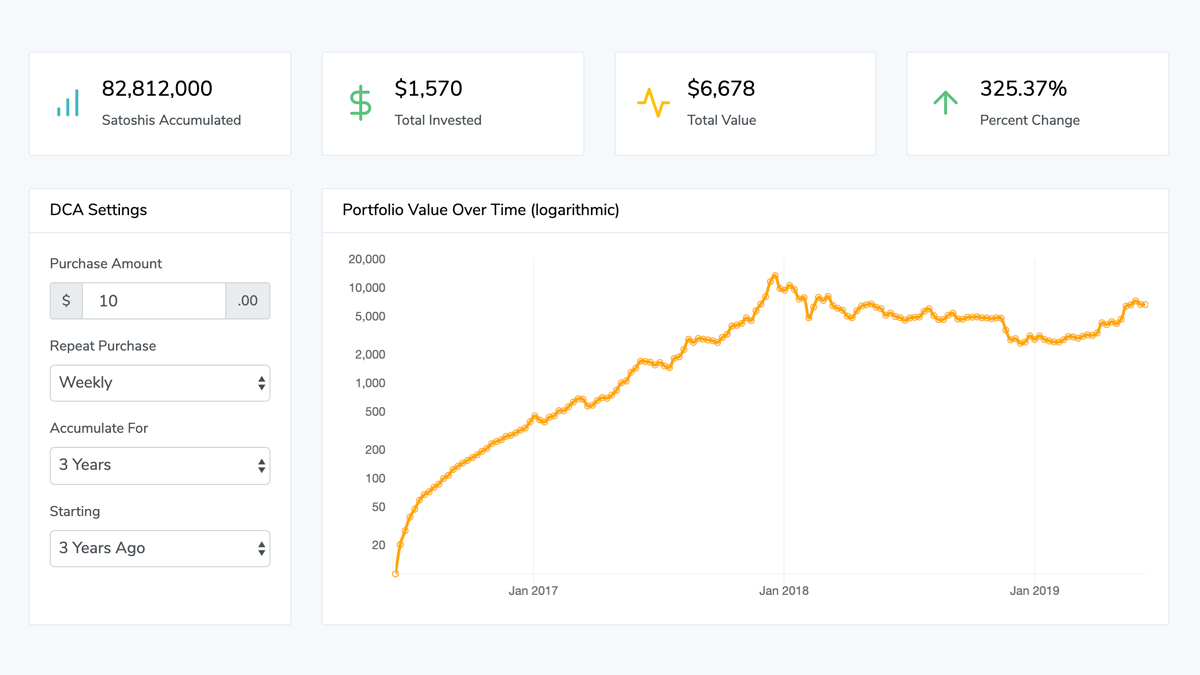

If there’s one thing I’d tattoo on my forehead for newbies, it’s dollar-cost averaging (DCA). Basically, you invest a fixed amount regularly—no matter if the price is pumping or dumping. I started this in 2023 when everything was bleeding out, putting $200 a week into Bitcoin and Ethereum. Felt stupid at first, buying during the bear market lows, but by late 2025 when BTC hit $126k, those cheap buys averaged out beautifully.

Why does this work for avoiding crypto losses? It removes emotion. No more FOMO tops or panic bottoms. Just consistent, boring buys. Experts over at places like Charles Schwab and Fidelity swear by it for volatile assets—check their guides if you don’t believe me (links below). In 2026, with the market consolidating around $3T cap, DCA is still king.

Diversifying Your Crypto Portfolio Without Going Insane

Another lesson from my dumbass phase: don’t put all your eggs in one basket, but also don’t spread so thin you can’t track shit. I aim for 60-70% in Bitcoin (digital gold, duh), 20-30% Ethereum, and tiny bits in solid alts like Solana if I’m feeling spicy. No more than 5-10% of my total investments in crypto overall—keeps the risk manageable.

Morgan Stanley talks about limiting crypto to 2-4% of your portfolio depending on aggression level. Solid advice I wish I’d followed earlier.

Security Tips for Crypto Investing That I Ignored (And Paid For)

Never leave big amounts on exchanges—FTX flashbacks, anyone? Get a hardware wallet. I use a Ledger now; transferred everything off Coinbase after one too many hack scares. Enable 2FA everywhere, and for god’s sake, write down your seed phrase on paper, not your phone.

Security.org has a great breakdown on this—multi-layered protection is non-negotiable in 2026.

Image Details for above: Close-up of a hardware wallet device connected to a computer, showing Bitcoin transfer screen—from an everyday user’s desk angle, slightly cluttered with notes. Descriptive alt text: “Secure hardware wallet setup for storing cryptocurrency offline.”

Wrapping This Ramble Up: My Genuine Take on Crypto Investing in 2026

Honestly, how to invest in crypto without losing money boils down to patience, small consistent moves, and not being a greedy moron like I was. Only invest what you can afford to lose—I’ve learned that the hard way multiple times. Research solid projects (CoinLedger has good long-term picks), avoid scams, and HODL through the noise.

If you’re starting now, grab a coffee, set up DCA on a reputable exchange like Coinbase or Kraken, get a hardware wallet, and chill. Check out these for more depth:

It’s not get-rich-quick, but done right, it can build real wealth. Hit me up in comments if you’ve got war stories—misery loves company, right? Start small today; future you will thank you.