Analyzing crypto trends like a pro has been this wild rollercoaster for me, seriously. I’m sitting here in my messy home office in the US right now—it’s mid-January 2026, snow piling up outside my window in the Midwest, coffee gone cold again because I got sucked into charts. Crypto trend analysis isn’t some polished thing; it’s me FOMOing into pumps, getting rekt on dumps, and slowly figuring out what actually works through trial and error.

I remember back in the 2024 bull run, I thought I was a genius analyzing crypto trends like a pro just by staring at TradingView all day. Bought some altcoin because the RSI looked “oversold”—ended up bagholding through a 80% crash. Embarrassing? Yeah, totally. But that’s how I learned: raw data over hype. Anyway, fast forward to now, with Bitcoin hovering around $90k after that early 2026 dip, and the market cap at like $3 trillion, I’m way more cautious. Institutional money is pouring in via ETFs, but volatility? Still insane.

Why I Even Bother Analyzing Crypto Trends Like a Pro

Look, crypto trend analysis saves my ass from impulse trades. I used to chase every Twitter pump—lost a chunk on some meme coin in 2025 because “sentiment was bullish.” Now? I mix tools and gut checks. It’s not perfect; sometimes I contradict myself, like being bullish on BTC long-term but scared short-term when macro news hits. But honestly, in this market, with predictions for 2026 saying BTC could hit new highs despite the four-year cycle breaking (check out Bitwise’s 2026 predictions for that), you gotta stay ahead.

:max_bytes(150000):strip_icc()/BTCMACD-db9c1c22f9ff46a995f500dde1d4555a.jpg)

My Go-To Ways to Analyze Crypto Trends: Technical Stuff First

Technical analysis is my bread and butter for analyzing crypto trends like a pro. I start with candlestick charts—those red and green bars tell stories. Bullish engulfing? I get excited. But I ignored a death cross once in late 2025, thought “this time different,” and nope, market tanked.

- Use moving averages: 50-day and 200-day. Golden cross (50 over 200) screams buy for me, but only if volume backs it.

- RSI and MACD: Overbought above 70? I take profits. That saved me during the October 2025 peak when BTC hit $126k.

- Support/resistance: Draw lines like crazy. Bitcoin’s been bouncing around $90k support lately—feels familiar from last year’s dips.

Tools? TradingView is free and addictive. For pros, check Glassnode for on-chain combo (more on that next). Here’s a solid guide on technical indicators from Kraken if you wanna dive deeper: https://www.kraken.com/learn/crypto-technical-indicators.

Diving Into On-Chain Metrics to Analyze Crypto Trends Like a Pro

This is where I leveled up. On-chain data is pure, no BS. Active addresses spiking? Real adoption. Exchange inflows? Whales dumping, run.

My big mistake: In 2025, ignored massive outflows to wallets, thought it was bearish—turns out accumulation before the run-up. Now I watch:

- Realized profits/losses: High profits taken? Top signal.

- HODL waves: Long-term holders not selling = strong.

- TVL in DeFi: Rising means money flowing in.

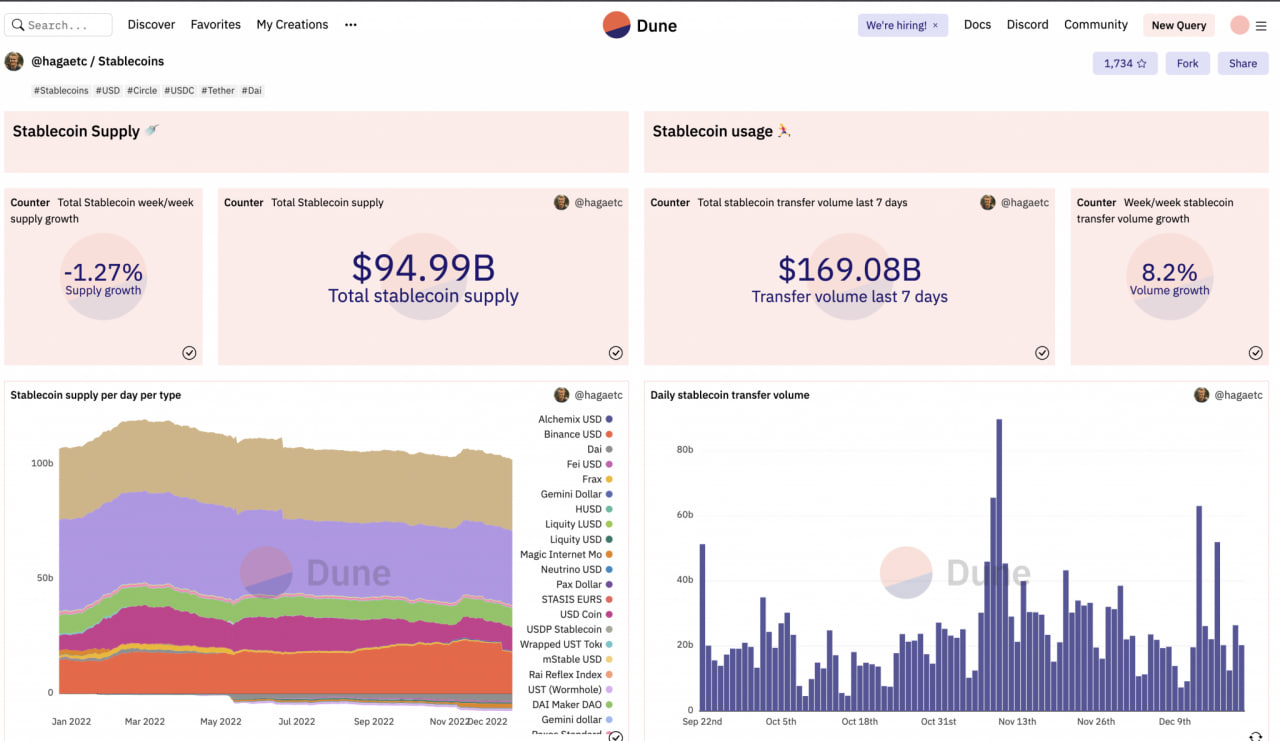

Glassnode and Dune Analytics are my faves—Glassnode’s studio dashboards feel like cheating. Nansen for whale tracking too. For free starts, CoinGlass for liquidations. Seriously, on-chain flipped my win rate. Link to Glassnode: https://glassnode.com/ — worth the sub if you’re serious.

Don’t Sleep on Sentiment When Analyzing Crypto Trends

Sentiment analysis is chaotic but fun. Twitter (or X) pumps coins overnight. I use LunarCrush or Santiment for social volume—spikes often precede moves.

But man, I got burned chasing Reddit hype in 2025. Now I cross-check with fear/greed index. Current? Greed, but cooling after that January pullback. Tools like Santiment rock for this: https://santiment.net/.

Pump It: Twitter Sentiment Analysis for Cryptocurrency Price …

Macro Factors Messing With My Crypto Trend Analysis

Crypto isn’t isolated anymore. Interest rates drop? Risk-on, crypto moons. But Fed hikes? Wrecked.

In 2026, with institutional adoption accelerating (Forbes nailed the trends here: https://www.forbes.com/sites/digital-assets/2026/01/02/5-trends-crypto-investors-cant-ignore-in-2026/), macro matters more. I watch stablecoin inflows and RWA tokenization news.

Are crypto markets correlated with macroeconomic factors?

Wrapping This Ramble: My Flawed Take on Analyzing Crypto Trends Like a Pro

Honestly, no one’s a real pro— we’re all guessing in this volatile mess. But combining TA, on-chain, sentiment, and macro? That’s how I’ve survived 2026 so far without total rekt. I still make dumb moves, like hesitating on dips, but learning from them is key.

Your turn: Grab TradingView, poke around Glassnode free tier, and start charting something boring like BTC first. Share your biggest mistake in comments—I bet it’s funnier than mine. Stay safe out there, frens. DCA if you’re scared, but analyze crypto trends like… well, like your wallet depends on it. Because it does.