DeFi innovations in 2026 are hitting me like a freight train, seriously—sitting here in my messy apartment in California, staring at my screens with a half-eaten burrito gone cold because I can’t look away from these RWA tokenization plays exploding everywhere.

Like, I gotta be honest, last year I dove headfirst into some restaking thing on Ethereum because everyone was hyping the interoperability upgrades, thinking it’d be my big win. Nope. Gas fees ate me alive one night when I tried bridging assets during a dip, and I ended up panic-selling at a loss. Embarrassing? Yeah, but that’s the raw truth—I’m just a regular dude in the US chasing these DeFi innovations, not some whale. Anyway, fast forward to now, and things feel different. Ethereum and Solana are pushing this reboot hard, with cheaper transactions and all these siloed ecosystems finally linking up. I tried Aerodrome on Base the other day, and wow, it actually felt smooth. No more fragmentation frustration.

My Take on DeFi Innovations: Why RWA Tokenization Is My Latest Obsession

RWA tokenization is straight-up one of the biggest DeFi innovations shaping the market right now. I’m talking real estate, bonds, even carbon credits getting tokenized on-chain. I remember reading about BlackRock and others dipping in last year, and thinking, “Nah, that’s for suits.” But then I aped into a small tokenized fund—tiny position, don’t judge—and watching it yield steady while the market volatility raged? Bittersweet, ’cause I wish I’d gone bigger earlier. Mistake noted.

- Institutional adoption is surging, like banks jumping into DeFi lending. Check out what Elliptic’s saying about global banks offering digital asset services.

- AI-powered yield optimization? I messed around with some bots, and one totally botched a trade during a flash crash. Lesson learned: these tools are game-changers but flawed, just like me.

- Flash loan resistant protocols are popping up everywhere, thank god, because those exploits used to keep me up at night.

It’s contradictory—I love the decentralization vibe, but these insti moves make it feel more legit, you know? Outbound link for credibility: Forbes on trends investors can’t ignore.

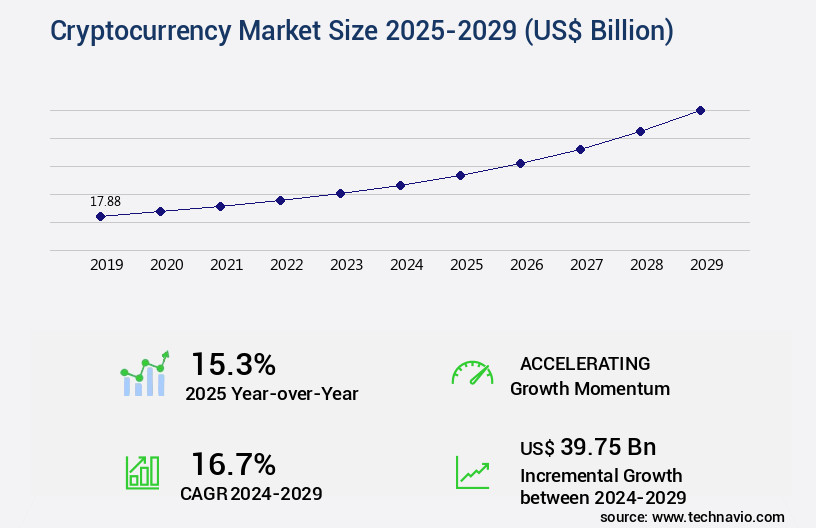

Cryptocurrency Market Size to Grow by USD 39.75 Billion from 2024 …

NFT Market Trends: From Hype Crash to Actual Utility (My Humbling Story)

NFT market trends in 2026? Man, they’re evolving big time, and I’m cautiously optimistic after getting burned bad in the old days. Back in the hype era, I FOMO’d into some PFP project—spent way too much on a “rare” one that tanked to zero. Self-deprecating laugh here: I still have it in my wallet as a reminder. But now? Utility is king. Gaming NFTs, metaverse land, even tokenized IP.

I recently grabbed some in a play-to-earn thing on Solana, and actually earning from in-game stuff feels… real? Not just jpeg flipping. Predictions say NFTs as software will boom, like programmable primitives. And with events getting canceled left and right ’cause the market cooled, it’s forcing real innovation.

- Shift to RWAs in NFTs: Fractional ownership of art or real estate? Mind-blowing.

- AI-curated collections: Tried minting one, turned out quirky and fun, but not masterpiece level.

- Brands dipping in carefully—Nike sold RTFKT, smart move avoiding the speculation trap.

Here’s a solid read on NFT predictions from Bankless.

Defi Neon Stock Photos – Free & Royalty-Free Stock Photos from …

Wrapping This Chat: DeFi Innovations and NFT Trends Feel Like a New Chapter

Honestly, these DeFi innovations and NFT market trends have me excited again, even with my screw-ups along the way. It’s chaotic—privacy protocols rising, stablecoins going institutional (that Trump-linked one? Wild)—but that’s crypto, right? Contradictions and all.

My advice from this flawed American perspective: Start small, like I should’ve, diversify into RWAs, and don’t ignore AI tools but test ’em hard. What’s your take? Drop a comment or hit me up—let’s talk what DeFi innovations you’re chasing next. Stay safe out there.